Top 10 Marriage Loans India Options and their Terms and Conditions

Feb 12, 2021

Feb 12, 2021Marriage loans India has a lot of options. But you just have to take a look at what interest rate they are providing wedding loans in India. And go with those bank which has better value and lesser interest rates for you. But for that peeping deep inside it is necessary. And that is why we have come up with best marriage loans in India.

Listed below are top 10 names of bank which provide shadi loan in India:

1) Tata Capital

Tata Capital has an interest rate of 10.99% on loan for girl marriage in India. So, major advantage of Tata Capital offer is minimal paperwork, zero charges on part repayment, no collateral, and flexible repayment options, etc. And they also have a loan tenure of 12 to 72 months. Moreover, Tata Capital has loan amount ranging from Rs. 75,000 to 25,00,000. And you just need PAN number, CIBIL score and KYC documents. Also, you need copies of your pay slips, address proof and bank statements.

2) ICICI Bank

ICICI bank has an interest rate of 10.50% on marriage loan interest rate in India. And ICICI bank has loan amount ranging from ₹ 50,000 to ₹ 25 Lakhs. So, you need just minimal documents for marriage loans India. And they offer no security or collateral option.

3) Axis Bank

Here you can avail the loan amount ranges between Rs.50,000 and Rs.15 lakh from Axis Bank. And you have to earn a minimum of Rs.15,000 or 25,000 per month to have this marriage loan. But it will depend upon the current city, age, etc. And maximum age limit for marriage loans India in this bank will be 21 or 23 years of age. So, you can also extend the repayment tenure to almost 5 years. And they have Axis eDGE Rewards points on their personal loans as well. And these points can be redeemed to get some amazing offers in future. And you have to show valid ID proof, valid address proof, proof of age, salary slip, etc. for the document verification procedure.

Check out 25 Latest Sangeet Songs for a Rocking Performance in Wedding Sangeet.

4) Bajaj Finserv

Bajaj Finserv offers the easiest way to get approval in just 5 minutes. And they are promising to have a marriage loan India in just 24 hours after your document verification. So, according to their provided info they need minimum documentation. And Bajaj Finserv has a flexible tenor of 24 to 60 months. So, they are offering you a wedding loan option of up to Rs. 25 lakh.

5) HDFC Bank

HDFC bank has an offer for HDFC bank customer. And for them they are promising to have wedding loan in just 10 seconds. So, their customer need little or no document for this personal loan. And for non customers also the loan can be sanctioned in just 4 hours. According to HDFC bank you can use this loan amount anywhere. So, they don’t put any kind of restrictions on this point. And they also have a flexible EMI and tenure options.

You might be interested in reading out 20 Mind Blowing and Unique Bridal Legs Mehndi Design for 2021 Wedding.

6) Monet Tap

Monet tap interest rate varies from 13% to 24.03% p.a. And they has a loan amount starting from ₹ 3,000 to ₹ 5 Lakh. So, the minimum salary required to apply for weeding loan is ₹ 20,000. And Monet Tap provides you loan with the minimum age of 23 or above. But according to them, you can use funds whenever it is needed and pay interest on whatever you use. And they offer you a flexible EMI which states from 2 months to 36 months. So, you have to show them valid ID proof and a proof of residence as a document.

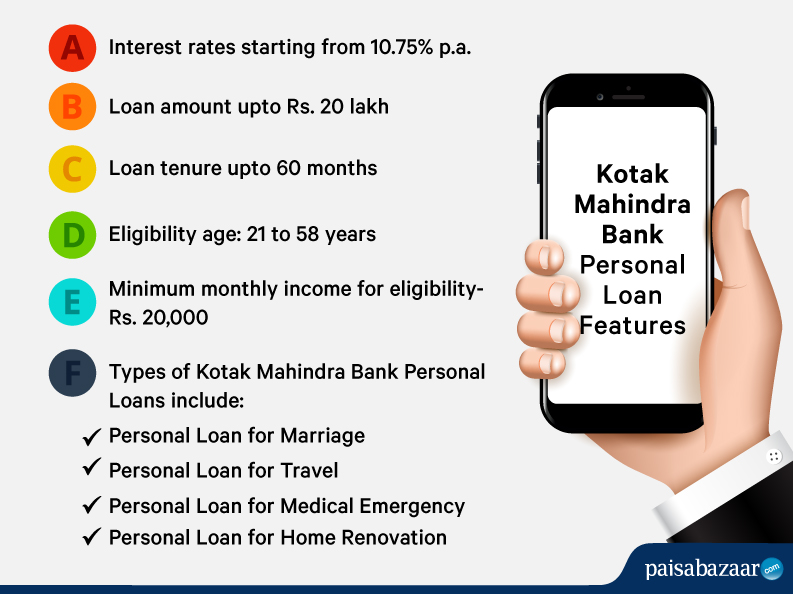

7) Kotak Mahindra Bank

Kotak Mahindra bank offers you shadi loan with an interest rate of 10.75% p.a. And you can avail loan amount between Rs.50,000 to Rs.20 lakhs. So, Kotak Mahindra bank has flexible EMI’s and tenures which ranges from 1 to 5 years. And they have a quick loan facility in just 3 seconds for Kotak Mahindra customers.

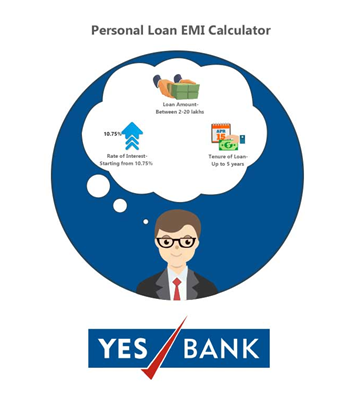

8) Yes Bank Marriage Loans India

This bank has an interest rate of 10.99%. And Yes bank has loan amount ranging from Rs. 1 Lakh to 40 Lakh. Mreover, they have a flexible tenor of 12-60 months. So, Yes bank says that there is no need for collateral. And they have an EMI calculator which checks whether you are eligible for a loan or not in just 1 minute.

Have a look at Latest Wedding Photography Concepts for your Wedding Photo shoot!

9) Standard Chartered

Standard Chartered has an interest rate 11.50% – 18.00% on wedding loan. And this bank has a loan tenure of 12 to 60 months. So, this bank is providing you the loan amount ranging from ₹ 1 Lakh to ₹ 50 Lakh. And preclosure charges are allowed after 1st EMI’s, 5% charges before 12 months, 4% charges after 12 months. So, the loan available for both salaried and self-employed professionals. And the loan can be taken by the age group of 23 and 58 years of age. Also, they have a processing fee of 1.00%..

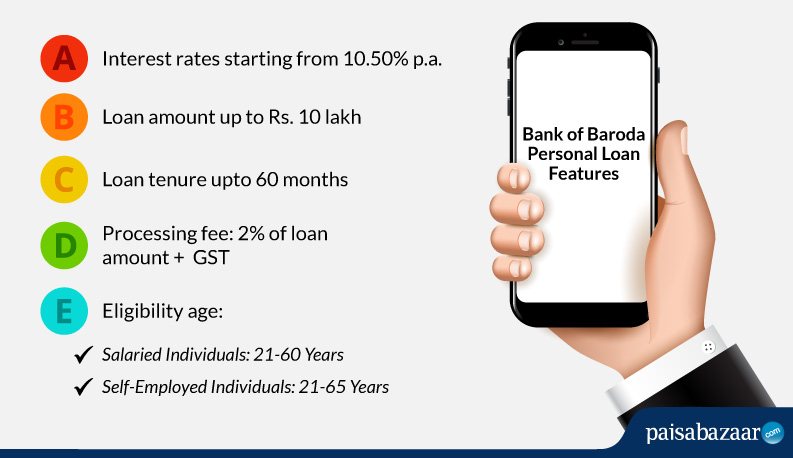

10) Bank of Baroda

Bank of Baroda has a marriage loans India amount of ₹ 50,000 to ₹ 5 Lakh. And this bank has an interest rate of 10.50% – 16.15%. Moreover, they just have a processing fee of 2%, Min Rs. 250. So, Bank of Baroda has a loan tenure of 12 months to 60 months. But preclosure charges are allowed after 1 EMI’s. And they have nil prepayment charges. But loan is available for both salaried and self-employed professionals.

Follow us on our insta handle for more updates.

Loading data...